How Will Working Affect Social Security Benefits

In a recent survey, 68% of current workers stated they plan to work for pay after retiring.1

And that possibility raises an interesting question: How will working affect Social Security benefits?

To answer that question requires an understanding of three key concepts: full-retirement age, the earnings test, and taxable benefits.

Full Retirement Age

Most workers don’t face an “official” retirement date, according to the Social Security Administration. The Social Security program allows workers to start receiving benefits as soon as they reach age 62—or to put off receiving benefits until age 70.

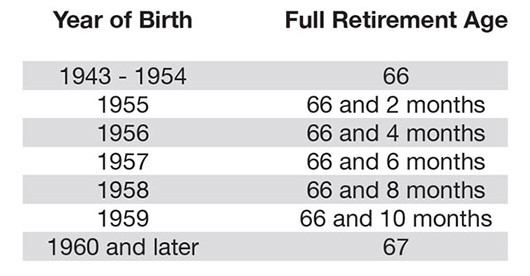

“Full retirement age” is the age at which individuals become eligible to receive 100% of their Social Security benefits. For example, individuals born in 1955 can receive 100% of their benefits at age 66 years and 2 months.2

Earnings Test

Starting Social Security benefits before reaching full retirement age brings into play the earnings test.

If a working individual starts receiving Social Security payments before full retirement age, the Social Security Administration will deduct $1 in benefits for each $2 that person earns above an annual limit. In 2019, the income limit is $17,640.3

During the year in which a worker reaches full retirement age, Social Security benefit reduction falls to $1 in benefits for every $3 in earnings. For 2019, the limit is $46,920 before the month the worker reaches full retirement age.4

For example, let’s assume a worker begins receiving Social Security benefits during the year he or she reaches full retirement age. In that year, before the month the worker reaches full retirement age, the worker earns $65,000. The Social Security benefit would be reduced as follows:

In this case, the worker’s annual Social Security benefit would have been reduced by $6,026 because he or she is continuing to work.

Taxable Benefits

Once you reach full retirement age, Social Security benefits will not be reduced no matter how much you earn. However, Social Security benefits are taxable.

For example, say you file a joint return and you and your spouse are past the full retirement age. In the joint return, you report a combined income of between $32,000 and $44,000. You may have to pay income tax on as much as 50% of your benefits. If your combined income is more than $44,000, as much as 85% of your benefits may be subject to income taxes.

There are many factors to consider when evaluating Social Security benefits. Understanding how working may affect total benefits can help you put together a program that allows you to make the most of all your retirement income sources—including Social Security.

What’s Your Full Retirement Age?

Those born in 1942 or before were already eligible for full Social Security benefits at age 65. For those born between 1943 and 1960, full retirement age increases incrementally until it reaches 67.

Source: Social Security Administration, 2019

1. Employee Benefit Research Institute, 2018

2,3,4. Social Security Administration, 2019

To learn more about CapSouth and the services we provide, contact us at 800.929.1001 or visit our website at www.capsouthwm.com

CapSouth Wealth Management – Dothan, AL, McDonough, GA, Charlotte, NC

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with CapSouth Wealth Management. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Copyright 2019 FMG Suite.

CapSouth Partners, Inc., dba CapSouth Wealth Management, is an independent Registered Investment Advisory firm. CapSouth does not offer tax, accounting or legal advice. Consult your tax or legal advisors for all issues that may have tax or legal consequences.