My 2 Percent’s Worth

Riding my bicycle 23 miles last Saturday was fun. It was the 23 miles on Sunday that got me. Possible culprits include consecutive 95 degree days and the fact that I’m no longer 25. Some (my wife) might suggest it was male ego, or something like that. I couldn’t really hear her for all the screaming from la region de derriere. Yes. La derriere. (And yes, thanks to Google, I am bilingual. And this French offering is brought to you by le Tour de France which begins July 4th. My favorite sporting event EVER, and maybe the only reason I’d mention France in a post. But I digress.) A friend had borrowed my bike a few weeks before, and I neglected to adequately adjust a certain aspect of the seat position upon its return. You see, I raised the seat, but didn’t move it – ever so slightly forward – which would have maintained the proper distance between la derriere and the handlebars. Consequently, I was poorly positioned for the 46 miles, and certain parts of my body still have not forgotten. Enough said. Point being, ever so slight adjustments can make a world of difference.

Riding my bicycle 23 miles last Saturday was fun. It was the 23 miles on Sunday that got me. Possible culprits include consecutive 95 degree days and the fact that I’m no longer 25. Some (my wife) might suggest it was male ego, or something like that. I couldn’t really hear her for all the screaming from la region de derriere. Yes. La derriere. (And yes, thanks to Google, I am bilingual. And this French offering is brought to you by le Tour de France which begins July 4th. My favorite sporting event EVER, and maybe the only reason I’d mention France in a post. But I digress.) A friend had borrowed my bike a few weeks before, and I neglected to adequately adjust a certain aspect of the seat position upon its return. You see, I raised the seat, but didn’t move it – ever so slightly forward – which would have maintained the proper distance between la derriere and the handlebars. Consequently, I was poorly positioned for the 46 miles, and certain parts of my body still have not forgotten. Enough said. Point being, ever so slight adjustments can make a world of difference.

Take your 401(k) for example. (I’m a master of segues.) As you’ve gathered from previous posts, I’m also a big fan of participating in employer-sponsored retirement plans. They’re a fantastic benefit – but only if you’re participating in them. If I’m speaking to you here, look into it. Here’s why: They’re easy to use and often provide free money in the way of a company match. This would be the free lunch you’ve always been told there was no such thing as? Let’s see how we can make the most of this free meal.

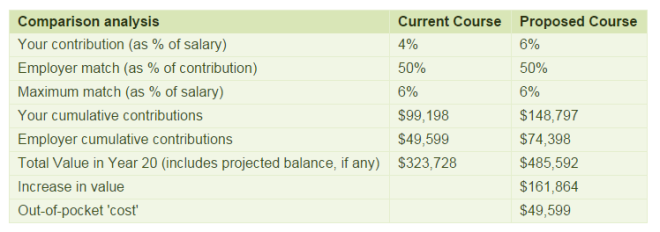

This comparison assumes a $75K annual salary, 8% annualized growth and a company match. Results are not guaranteed.

The above illustrates the benefit of saving just 2 percent more of your check each pay period. You were saving 4%, now you’re saving 6%. Your employer, in this case, was matching 50% of your 4% contribution, now they’re matching 50% of your 6% contribution. With this slight increase, not only are you saving more of your own money for retirement, you’re now taking full advantage of the company’s money – or maxing the match, as they say. Before the increase, however, you were leaving 2% on the table in uncollected matching contributions – or free money as we’ve called it.

If they’re offering you free money…take it.

Here’s where the rubber hits the road: Your slight adjustment in contribution percentage, after 20 years of compounding interest and the additional employer contribution, could yield nearly $162,000.00 of additional padding to your 401(k)! That’s a big benefit for a relatively small change, no? As stated, assumptions are being made here – a $75K annual salary, 8% annual growth, there’s a company match, and the fact that you can swing the contribution increase in the first place. Given the likelihood of rising healthcare costs and the uncertainty swirling around social security, the case could be made that you can’t afford not to swing the contributions. What would a small increase in your 401(k) contribution percentage look like? Looks like additional padding to me. And who among us couldn’t benefit from additional padding…ahem.